This month, your water bill seems excessively high. A further look shows a break in your underground waterpipe. To get to the source of the damage and complete major repairs, you must excavate your front lawn. That will leave you with a massive ditch, exposed piping and an expensive bill to pay.

Unfortunately, this could be reality for any homeowner. Underground service lines transport water, waste, heating, cable, internet and more to and from your house. A leak, break, tear, rupture or collapse can easily damage these underground pipes or wires, creating costly repairs and disrupting your daily routine.

Adding underground service line coverage to your home insurance can help you cover the costs to repair or replace service lines. Learn more about how service line coverage works and how it can come in handy.

What sections of the service line am I responsible for?

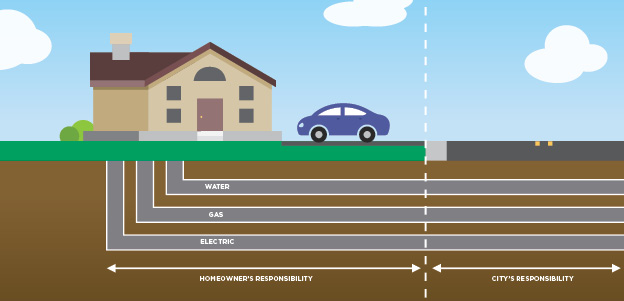

Homeowners are legally responsible for maintaining service lines from their home to their property line. And, standard homeowners policies don’t cover service line damage, which means you are on the hook financially for any damaged lines between the street and your house. This can potentially add up to thousands of dollars in repairs.

This infographic below helps explain where you are responsible for maintaining the service lines and where your city, village or township is responsible.

How service line coverage can bridge the gap

Like most homeowners, you may have received offers in the mail from utility providers sharing coverage options. And, like most homeowners, you may not be sure about the type of coverage you need. Many times, these contracts are limited in scope, cover only one service line and are an expensive alternative to coverage options through your insurance company.

Adding underground service line coverage to your homeowners policy is a smart way to bridge this coverage gap and make sure you’re adequately protected for the future. The endorsement helps you cover costs for things like excavation, piping repairs and replacements, wiring repairs and replacements, additional living expenses and landscaping repairs. Some carriers even offer additional benefits if you make eco-friendly or energy-efficient upgrades when replacing your equipment.

You can’t always stop damage from impacting your service lines, but you can take necessary steps to prepare. By adding service line coverage to your homeowners insurance policy, you can make sure you’re adequately protected and finally bridge the service line coverage gap for good.

How much do utility line repairs cost?

According to Forbes, 2024 pricing for minor localized sewer repairs “start around $650 and can range up to $7,500 for 30 feet of sewer line replacement, with an average of around $4,000.” The cost for repairs can reach as high as $20,000 to complete sewer line repair under slab.

No two repair projects are the same—cost will vary based on the type of sewer line replacement, the linear feet of space impacted, the distinctions between clogs, breaks or collapsed lines and more. Plus, the extent of damage can determine how long you’re left without water, gas or electricity during repairs.

How much does underground service line coverage cost?

There is good news for your service lines! Coverage is a fraction of the cost of the average utility line repairs, typically running between $20 and $50 per year. This additional insurance can really come in handy for your overall homeowners insurance coverage.

Learn about our

Home Insurance

References

Forbes

Coverages described herein may not be available in all states. Please contact a local independent Grange agent for complete details on coverages and discounts. If the policy coverage descriptions herein conflict with the language in the policy, the language in the policy applies. The material provided above is for informational, educational, or suggestion purposes and does not imply coverage. WE RESERVE THE RIGHT TO REFUSE TO QUOTE ANY INDIVIDUAL PREMIUM RATE FOR THE INSURANCE HEREIN ADVERTISED. Grange Insurance policies are underwritten by Grange Insurance Company, Trustgard Insurance Company, Grange Indemnity Insurance Company, Grange Insurance Company of Michigan and Grange Property & Casualty Insurance Company*. Not all companies are licensed in all states. *Not licensed in Pennsylvania.