Actual cash value vs. replacement cost: Which one’s best for you?

Posted in Home

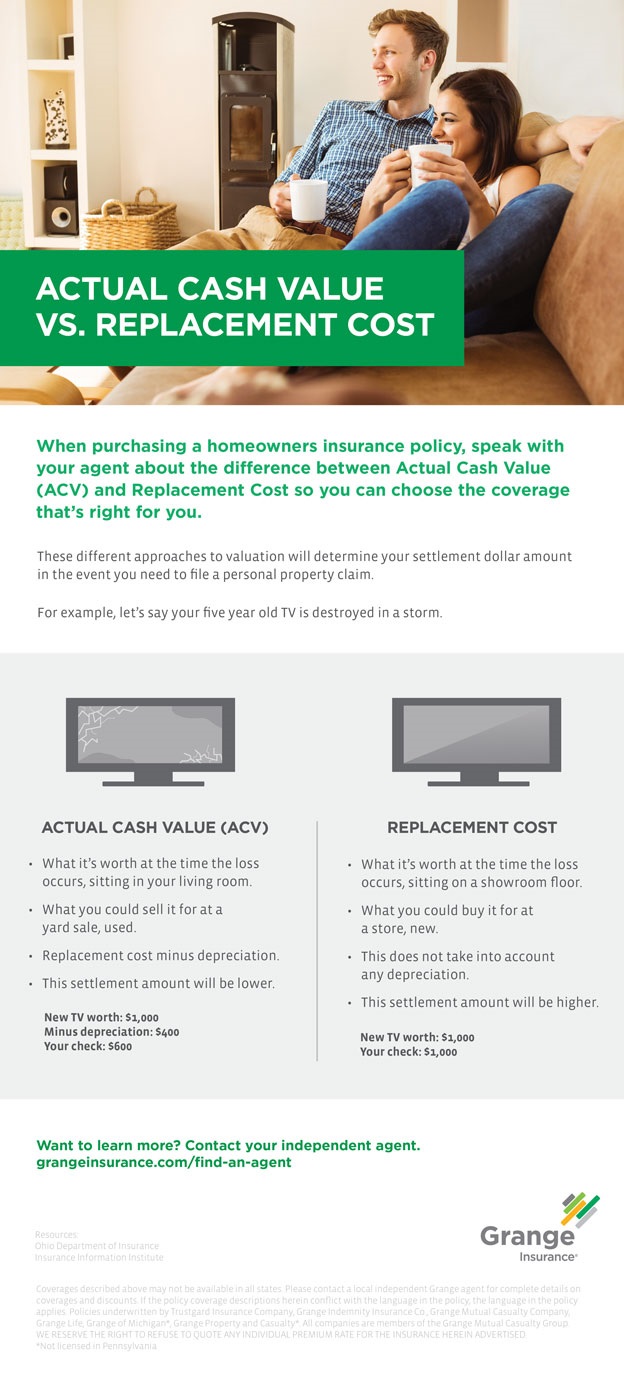

Imagine this situation. About five years ago, you bought a new flat screen TV for over $1,000. Then after a thunderstorm rolls through, it won’t turn on. It’s destroyed.

So, you file a claim with your insurance company, but you’re left confused when your settlement check is less than $1,000. After all, that’s what you paid for the TV, right?

It all comes down to the type of contents coverage you’ve selected in your homeowners insurance policy: actual cash value or replacement cost value.

But you can avoid this confusing situation by reviewing your coverage options with your independent insurance agent ahead of time. Check out our infographic about actual cash value and replacement cost to help you understand the difference so you can choose the right coverage for your home insurance policy.

Learn about our

Home Insurance

Related resources

Posted in Home

When it rains, it pours. And if your sump pump fails, it can pour inside your home, too. Learn why homeowners are choosing to add water backup coverage to their home insurance policies, as well as six tips to prevent a water backup.

Posted in General, Auto, Home, Business

Your life and business are constantly updating and changing. It’s essential that your insurance stays up-to-date with your life to make sure your coverage is accurate in the event of a loss. Learn about the ins and outs of an annual insurance review.