In our tech-driven world, protecting your property with both home cyber insurance and identity theft insurance is more important than ever before. Each of these types of insurance add protection to your homeowners policy that provide peace of mind in a variety of different scenarios.

Learn the benefits of identity theft insurance and home cyber insurance plus important differences between the two types of protection. Understanding the unique features of each will help you decide what safeguards are best for your needs.

Watch the following video to learn how Grange can help you protect your digital footprint and identity with home cyber insurance and identity theft insurance.

What does home cyber insurance protection do?

Home cyber insurance, also known as personal cyber insurance , is an add-on to your home insurance policy that helps when you are a victim of a computer attack, home systems attack, cyber extortion, online fraud or a data breach.

For example, let’s say you are going through your email inbox on your home desktop computer. You open an email and download the attached file. Unfortunately, the file has a virus and your computer is now compromised. Personal cyber insurance will help cover the costs to hire a professional to reformat the hard drive, reinstall the operating system and restore data from the backup.

Many types of technology around your home are at risk without proper personal cyber protection, including:

- Smart home devices like speakers, plugs, thermostats and lights

- Tablets, laptops, computers and phones

- Pet cameras, home security cameras, video doorbells and smart locks

With the help of home cybersecurity, you can bounce back faster and easier if you’re ever subjected to a cyber crime. Talk to your insurance agent today to learn how you can add home cyber insurance to your homeowners policy.

Learn about our

Home Insurance

What does identity theft protection do?

Identity theft insurance is also an add-on for your homeowners insurance. This insurance helps in cases where you are a victim of a data breach or identity theft.

Identity theft insurance coverage is different than what your banks and credit card companies may provide if your identity is stolen. Where they can offer services to monitor your identity, banks and credit card companies may not help you with expenses to restore your identity. Identity theft protection is important because it closes the gap to protect your identity after you become a victim. Identity theft insurance provides restoration services plus helps pay for covered expenses incurred from identity theft.

For example, let’s say you get a phone call from a telemarketing scam posing as a trusted company, such as your primary bank. During the phone call they ask for your Social Security Number to confirm your account and identity. Unfortunately, a few days later your bank account is hacked and the money in the account is depleted. Then, someone uses your identity to open a loan in your name. Identity theft insurance will help cover the costs to recover your identity and ownership of your accounts, plus any other covered expenses related to the identity theft.

You can experience identity theft when someone takes your personal, identifying information to:

- Open credit cards or other new accounts for financial gain

- Steal money from existing accounts

- Apply for loans

- Rent an apartment

- And much more

Check out our identity theft insurance page to learn more about the potential risks of identity theft and how the right coverage can keep your identity safe.

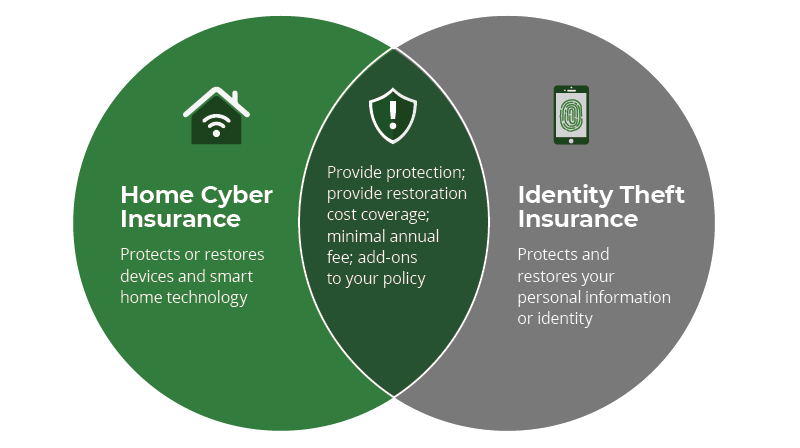

Compare personal cyber insurance and identity theft insurance to understand why it’s essential to protect your digital life with both types of insurance coverage.

How much is identity theft insurance and home cyber insurance?

It depends on your homeowners insurance carrier. At Grange, our customers can add identity theft insurance to any home insurance or auto insurance policy for as little as $10 per year. Grange home insurance customers can also add home cyber insurance for a competitive rate. Talk to a Grange independent agent today to learn more.

Why you need both types of coverage

The best way to protect your family and devices from cyber and identity threats is to add the appropriate coverage to your policy. Home cyber insurance and identity theft insurance from Grange can offer peace of mind and protection if you are the victim of a computer attack, home systems attack, cyber extortion, online fraud, data breach and identity theft.

Contact your Grange independent agent to add the protection of home cyber insurance and identity theft insurance to your policy today.

This article is for informational and suggestion purposes only. Implementing these suggestions does not guarantee coverage. If any policy coverage descriptions in this article conflict with the language in the policy, the language in the policy applies. For full details on Grange’s auto insurance and home insurance coverages and discounts, contact your local independent agent.

References:

Tech Rader

PNC